The entrepreneurs, who all have experienced the problems they’re trying to solve, are teaming up with behavioral science nonprofit Ideas42 and Wells Fargo to create the tools that could have helped them.

When LaToria Pierce was born, her mother was just 18 years old. She was 16 when Pierce’s older sister was born. Throughout her childhood, Pierce saw how her mother struggled financially, as she balanced work with childcare, living “a day at a time” on each paycheck. “Young, single mothers,” Pierce says, “have always had to find some way to navigate, and strategize, to survive.”

As a result of her experience, Pierce has sought throughout her career to build ways to ease people’s financial burdens, including helping to develop an income security fintech tool when she worked for the AARP. Now, Pierce is one of four entrepreneurs in the process of launching their own tech products to help cut down excess costs of poverty for low-income individuals, as part of an 18-month venture initiative, largely funded by Wells Fargo. This “Shared Prosperity Catalyst” is the brainchild of nonprofit Ideas42, which has been studying the role of behavioral science in chronic poverty, and is helping the entrepreneurs apply behavioral techniques as they build their tools. Crucially, the candidates are from low-income backgrounds, which allows them to empathize with the poor, and solve for problems they’ve experienced firsthand.

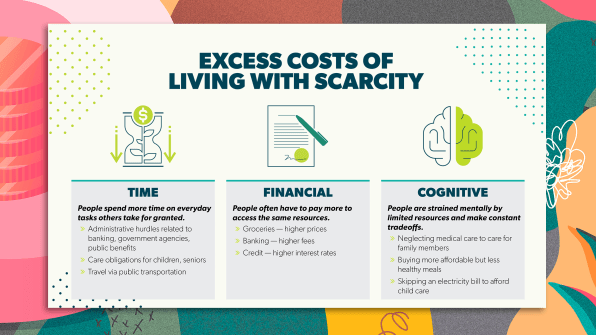

“It’s very expensive to be poor in the U.S.,” says Josh Wright, Ideas42’s executive director. Costs of essential services are higher to begin with for those with lower incomes, and budgets are destabilized even further by costs just to access services, like banking or insurance, which are paradoxically higher for the poor. Lower-income individuals also have no choice but to buy cheaper, less-reliable assets, and then pay for fixing and replacing them down the line. “The people who need the help the most are often least able to access it,” Wright says. Then, they must deal with nonfinancial costs like time, energy, and “cognitive tax”—the strain of constantly having to decide what they can and can’t afford, and making uncomfortable trade-offs for their families.

Now, six months in, all the entrepreneurs have decided on their businesses and are transitioning from the ideation stage into prototyping. For inspiration for her idea, Pierce started with her own mother. “If my 18-year-old mom came to me with two kids—little LaTonya and LaToria—how would I help her?” She settled on a “shared job model,” in which two people, such as single mothers, would be able to share a single job role at a company, splitting the work, to allow them flexibility for their often-chaotic schedules, but also allowing them good, steady incomes. This “pass-the-baton” model would also give single mothers a chance to do meaningful work, which they’re often passed over for because of schedules. “They’re hardworking,” she says. “They’re a major source of untapped talent.”

Pierce is developing the software product to house the idea. Representatives from Ideas42 are on hand to help bake behavioral aspects into the design from the start. In general, Wright says, behavioral science helps with “knowing and understanding how humans decide and follow through on their decisions.” For example, Pierce’s product will want to eliminate “status quo bias,” whereby employers may want to do things a certain way because that’s how they’ve always been done. The tech interventions will be about reducing the burden for bosses. For example, design elements may allow for an employer to easily assign work via email to both employees of the shared job so that the right person on duty will be guaranteed to get it; then, perhaps it’ll be up to that worker to update their teammate via a video feature, to further minimize inconvenience to the higher-ups.

In his past ventures, another of the entrepreneurs, Kortney Ziegler, was using behavioral science ideas without doing it intentionally. He built and ran a crowdfunding platform called Appolition, which collected charitable donations to help pay people’s bails. His new business broadens that idea: It’s a “cost-sharing community for emergencies,” essentially a pot of money within a community that people can donate to and take from in case of urgent needs, “no questions asked”—so people don’t have to resort to payday lenders or GoFundMe campaigns, incurring more debt and taking a hit to their dignity, he says, by having to “do some kind of performative ask online.”

When designing for Ziegler’s product, Wright says thought will have to be giving to behavioral concepts like “mental accounting,” whereby people may ascribe different value to the same amount of money according to how they spend it. So, in order for contributors to the cash pool to not feel as if they’re giving away too much, it may help to develop a structure in which, perhaps, they donate the cost of a coffee once a week, which they’d usually be spending anyway. Designers may also consider the “warm-glow effect,” when people feel more of an emotional urge to give after hearing a story about a single person in need and their plight, versus data about a group of needy people.

Fundamental to all the enterprises (the remaining two businesses are a downpayment assistance program for low-income individuals to access the housing market, and a more streamlined way for retiring business owners to sell their company to their employees) is empathy, another behavioral science concept that underlined the creation of the entire program. The four entrepreneurs needed to be from low-income backgrounds, thus aware of the reality of the problems they’re solving for. Most traditional entrepreneurs—relatively wealthy and white—wouldn’t be able to relate to the inability to fork out for emergencies such as a car repair; or missing a gig shift that could cost a paycheck and “make or break someone’s life,” Ziegler says. In fact, 40% of Americans can’t come up with $400 for an emergency without borrowing or selling. Ziegler says that growing up low income in Compton (and having an academic background in African American studies) informs his decisions. Not that other businesspeople can’t be sympathetic, he says, but “I definitely think your lived experience shapes what you build, and how you build.”

That highlights the importance of diversity in entrepreneurship. Only 1% to 3% of venture capital funding typically goes to Black and Latino founders, and just 9% goes to women. All four entrepreneurs in the program are people of color, or women (or both), and that was important for Wells Fargo, “because they know what would be a meaningful change in their lives,” says Darlene Goins, senior vice president and head of financial health philanthropy. The financial services company is funding $15 million in total for the entire project, Goins says—which also allows for another cohort of entrepreneurs, who will be on-boarded next year.

Aside from the four ventures, there are also two other elements of the program designed to tackle the systemic reasons for poverty. The first is finding “narrative” solutions: Ideas42 is testing behavioral science-informed messaging for overhauling the way false stereotyping contributes to poverty, and will partner with grassroots community organizations around the country. The second is a policy lab where the nonprofit will propose behavioral-based anti-poverty policies for all levels of government.

The hope is for the four businesses to scale so that they can have real impact on driving down the costs associated with poverty. One of the measures of success, Goins says, will be that the entrepreneurs are able to gain additional investment after the 18 months in order for that scaling up to happen. At that point, they hope to be able to show future investors that they’ve sold pilots of their products to partners and implemented them in some way. Pierce, for instance, is already talking to small and midsize businesses to help launch pilots for her job-sharing business; she also wants Fortune 500 companies to be involved.

Pierce says a friend of hers recently asked whether she feels like an imposter in this white- and wealth-dominated world of entrepreneurship. She doesn’t. “The work that I’m doing, and the folks I seek to serve: This has been my life,” she says. “It’s not just something that I saw, but that I lived. I watched my mom trying to figure it out.”

"poor" - Google News

July 29, 2021 at 06:00PM

https://ift.tt/3l4VBNv

Ideas42 and Wells Fargo launch anti-poverty ventures - Fast Company

"poor" - Google News

https://ift.tt/2ykjlaA

https://ift.tt/3djK71y

Bagikan Berita Ini

0 Response to "Ideas42 and Wells Fargo launch anti-poverty ventures - Fast Company"

Post a Comment